|

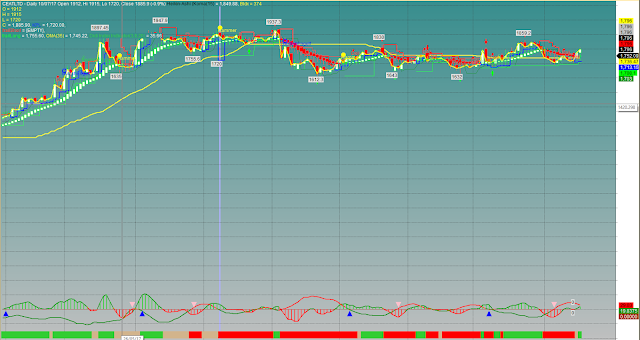

| Candle Pattern Detector Heiken Ashi |

//www.aflcode.com _SECTION_BEGIN("Heikin-Ashi (Koma"); /* Heikin-Ashi(Koma-Ashi) with Moving Average Type */ SetChartOptions(2, chartWrapTitle); // Calculate Moving Average MAPeriod = Param("MA Period", 15, 1, 100); MAOpen = EMA(Open, MAPeriod); MAHigh = EMA(High, MAPeriod); MALow = EMA(Low, MAPeriod); MAClose = EMA(Close, MAPeriod); HaClose = (MAOpen + MAHigh + MALow + MAClose) / 4; HaOpen = AMA(Ref(HaClose, - 1), 0.5); // for graph collapse for (i = 0; i <= MAPeriod; i++) HaClose[i] = Null; /* // same // HaOpen = (Ref(HaOpen, -1) + Ref(HaClose, -1)) / 2; HaOpen[ 0 ] = HaClose[ 0 ]; for(i = 1; i < BarCount; i++) { HaOpen[i] = (HaOpen[i - 1] + HaClose[i - 1]) / 2; } */ HaHigh = Max(MAHigh, Max(HaClose, HaOpen)); HaLow = Min(MALow, Min(HaClose, HaOpen)); // outs comments "BarIndex = " + BarIndex(); "Open = " + Open; "High = " + High; "Low = " + Low; "Close = " + Close; "HaOpen = " + HaOpen; "HaHigh = " + HaHigh; "HaLow = " + HaLow; "HaClose = " + HaClose; // Plot graphs _N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} HaOpen %g, HaHigh %g, HaLow %g, HaClose %g (%.1f%%) {{VALUES}}", HaOpen, HaHigh, HaLow, HaClose, SelectedValue(ROC(HaClose, 1)))); PlotOHLC(HaOpen, HaHigh, HaLow, HaClose, _DEFAULT_NAME(), ParamColor("Color", colorBlack), styleCandle); /* ********************************** Code to automatically identify pivots ********************************** */ // -- what will be our lookback range for the hh and ll? farback = Param("How Far back to go", 100, 50, 5000, 10); nBars = Param("Number of bars", 12, 5, 40); // -- Title. Title = Name() + " (" + StrLeft(FullName(), 15) + ") O: " + Open + ", H: " + High + ", L: " + Low + ", C: " + Close; // -- Plot basic candle chart PlotOHLC(Open, High, Low, Close, "BIdx = " + BarIndex() + "\n" + "O = " + O + "\n" + "H = " + H + "\n" + "L = " + L + "\n" + "C ", colorYellow, styleLine | styleThick); GraphXSpace = 7; // -- Create 0-initialized arrays the size of barcount aHPivs = H - H; aLPivs = L - L; // -- More for future use, not necessary for basic plotting aHPivHighs = H - H; aLPivLows = L - L; aHPivIdxs = H - H; aLPivIdxs = L - L; nHPivs = 0; nLPivs = 0; lastHPIdx = 0; lastLPIdx = 0; lastHPH = 0; lastLPL = 0; curPivBarIdx = 0; // -- looking back from the current bar, how many bars // back were the hhv and llv values of the previous // n bars, etc.? aHHVBars = HHVBars(H, nBars); aLLVBars = LLVBars(L, nBars); aHHV = HHV(H, nBars); aLLV = LLV(L, nBars); // -- Would like to set this up so pivots are calculated back from // last visible bar to make it easy to "go back" and see the pivots // this code would find. However, the first instance of // _Trace output will show a value of 0 aVisBars = Status("barvisible"); nLastVisBar = LastValue(Highest(IIf(aVisBars, BarIndex(), 0))); _TRACE("Last visible bar: " + nLastVisBar); // -- Initialize value of curTrend curBar = (BarCount - 1); curTrend = ""; if (aLLVBars[curBar] < aHHVBars[curBar]) { curTrend = "D"; } else { curTrend = "U"; } // -- Loop through bars. Search for // entirely array-based approach // in future version for (i = 0; i < farback; i++) { curBar = (BarCount - 1) - i; // -- Have we identified a pivot? If trend is down... if (aLLVBars[curBar] < aHHVBars[curBar]) { // ... and had been up, this is a trend change if (curTrend == "U") { curTrend = "D"; // -- Capture pivot information curPivBarIdx = curBar - aLLVBars[curBar]; aLPivs[curPivBarIdx] = 1; aLPivLows[nLPivs] = L[curPivBarIdx]; aLPivIdxs[nLPivs] = curPivBarIdx; nLPivs++; } // -- or current trend is up } else { if (curTrend == "D") { curTrend = "U"; curPivBarIdx = curBar - aHHVBars[curBar]; aHPivs[curPivBarIdx] = 1; aHPivHighs[nHPivs] = H[curPivBarIdx]; aHPivIdxs[nHPivs] = curPivBarIdx; nHPivs++; } // -- If curTrend is up...else... } // -- loop through bars } // -- Basic attempt to add a pivot this logic may have missed // -- OK, now I want to look at last two pivots. If the most // recent low pivot is after the last high, I could // still have a high pivot that I didn't catch // -- Start at last bar curBar = (BarCount - 1); candIdx = 0; candPrc = 0; lastLPIdx = aLPivIdxs[0]; lastLPL = aLPivLows[0]; lastHPIdx = aHPivIdxs[0]; lastHPH = aHPivHighs[0]; if (lastLPIdx > lastHPIdx) { // -- Bar and price info for candidate pivot candIdx = curBar - aHHVBars[curBar]; candPrc = aHHV[curBar]; if ( lastHPH < candPrc AND candIdx > lastLPIdx AND candIdx < curBar) { // -- OK, we'll add this as a pivot... aHPivs[candIdx] = 1; // ...and then rearrange elements in the // pivot information arrays for (j = 0; j < nHPivs; j++) { aHPivHighs[nHPivs - j] = aHPivHighs[nHPivs - (j + 1)]; aHPivIdxs[nHPivs - j] = aHPivIdxs[nHPivs - (j + 1)]; } aHPivHighs[0] = candPrc; aHPivIdxs[0] = candIdx; nHPivs++; } } else { // -- Bar and price info for candidate pivot candIdx = curBar - aLLVBars[curBar]; candPrc = aLLV[curBar]; if ( lastLPL > candPrc AND candIdx > lastHPIdx AND candIdx < curBar) { // -- OK, we'll add this as a pivot... aLPivs[candIdx] = 1; // ...and then rearrange elements in the // pivot information arrays for (j = 0; j < nLPivs; j++) { aLPivLows[nLPivs - j] = aLPivLows[nLPivs - (j + 1)]; aLPivIdxs[nLPivs - j] = aLPivIdxs[nLPivs - (j + 1)]; } aLPivLows[0] = candPrc; aLPivIdxs[0] = candIdx; nLPivs++; } } // -- Dump inventory of high pivots for debugging /* for (k=0; k<nHPivs; k++) { _TRACE("High pivot no. " + k + " at barindex: " + aHPivIdxs[k] + ", " + WriteVal(ValueWhen(BarIndex()==aHPivIdxs[k], DateTime(), 1), formatDateTime) + ", " + aHPivHighs[k]); } */ // -- OK, let's plot the pivots using arrows PlotShapes(IIf(aHPivs == 1, shapeDownArrow, shapeNone), colorRed, 0, High, Offset = - 15); PlotShapes(IIf(aLPivs == 1, shapeUpArrow, shapeNone), colorBrightGreen, 0, Low, Offset = - 15); _SECTION_END(); //***************************************** //***************************************** //PRICE //xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx //TRENDING RIBBON // Paste the code below to your price chart somewhere and green ribbon means both // both MACD and ADX trending up so if the red ribbon shows up the MACD and the ADX // are both trending down. _SECTION_BEGIN("trending ribbon"); uptrend=PDI()>MDI() AND MACD()>Signal(); downtrend=MDI()>PDI() AND Signal()>MACD(); Plot( 2, /* defines the height of the ribbon in percent of pane width */"", IIf( uptrend AND EMA(C,50)>=Ref(EMA(C,50),-1), colorLime, IIf( downtrend OR EMA(C,50)<Ref(EMA(C,50),-1), colorRed, colorTan)) , /* choose color */styleOwnScale|styleArea|styleNoLabel, -0.5, 100 ); _SECTION_END(); //xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx //TREND ADVISER pointer[0] = 0; /* Phase filter */ Cond1 = Close > MA(Close, 50)AND NOT(Close > MA(Close, 200))AND NOT(MA(Close, 50) > MA(Close, 200)); Cond2 = Close > MA(Close, 50)AND Close > MA(Close, 200)AND NOT(MA(Close, 50) > MA(Close, 200)); Cond3 = Close > MA(Close, 50)AND Close > MA(Close, 200)AND MA(Close, 50) > MA(Close, 200); Cond4 = NOT(Close > MA(Close, 50))AND Close > MA(Close, 200)AND MA(Close, 50) > MA(Close, 200); Cond5 = NOT(Close > MA(Close, 50))AND NOT(Close > MA(Close, 200))AND MA(Close, 50) > MA(Close, 200); Cond6 = NOT(Close > MA(Close, 50))AND NOT(Close > MA(Close, 200))AND NOT(MA(Close, 50) > MA(Close, 200)); for (i = 1; i < BarCount; i++) { if (Cond1[i]) pointer[i] = 1; if (Cond2[i]) pointer[i] = 2; if (Cond3[i]) pointer[i] = 3; if (Cond4[i]) pointer[i] = 4; if (Cond5[i]) pointer[i] = 5; if (Cond6[i]) pointer[i] = 6; } /* Plot Graphic */ //GraphXSpace= 15 ; dynamic_color = IIf(pointer < 4, colorGreen, colorRed); //Plot(pointer, "TrendAdv2", dynamic_color, styleHistogram | styleThick, Null, Null, 0); //SetChartBkGradientFill(ParamColor("BgTop", colorWhite), ParamColor("BgBottom", colorLightYellow)); Cond= pointer < 4 ; //xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx //KPL /* my entry is very simple(daily data for trading) kpl system for entry only & exit as follow: 1 st exit at x % from entry price only 1/3 quantity.(ie 1st profit target) 2 nd exit when exit Signal comes from kpl sys remaining 1/3 quantity. 3. scale-in to initial quantity if new kpl Buy Signal comes. re-do above scaling-out & scaling-in till filal exit. 4. final exit all quantity when Close below 21 Day EMA. kpl system code bellow : */ //AFL by Kamalesh Langote. Email:kpl@... noR =Param( "SwingR", 5, 1, 55 ) ; noS =Param( "SwingS", 2, 1, 55 ) ; res=HHV(H,noR); sup=LLV(L,noS); avd=IIf(C>Ref(res,-1),1,IIf(C<Ref(sup,-1),-1,0)); avn=ValueWhen(avd!=0,avd,1); tsl=IIf(avn==1,sup,res); //tsl_col=ParamColor( "Color", colorCycle ); tsl_col= IIf(avn==1,colorBlue,colorRed ); Plot(tsl, "KPL", tsl_col, styleStaircase | styleThick); //shape=Buy*shapeUpArrow + Sell*shapeDownArrow; //PlotShapes(shape,IIf(Buy,colorBlue,colorRed),0,IIf(Buy,Low,High)); SetPositionSize(300,spsShares); ApplyStop(0,1,10,1); //xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx _SECTION_BEGIN("Background"); SetChartBkGradientFill(ParamColor("Top", colorTeal), ParamColor("Bottom", colorLightGrey), ParamColor("Title", colorTeal)); SetChartBkColor(ParamColor("Chart Background", colorWhite)); _SECTION_END(); _SECTION_BEGIN("trends trail SVE"); function trends_func(resistance) { trends = (H+L)/2; // initialize support = (H+L)/2; // initialize for( i = 4; i < BarCount; i++ ) { // support prev = support[ i - 1 ]; if (L[ i ] >= L[ i - 2 ] AND L[ i - 1 ] >= L[ i - 2 ] AND L[ i - 3 ] >= L[ i - 2 ] AND L[ i - 4 ] >= L[ i - 2 ]) { support[ i ] = L[ i - 2 ]; } else if (L[ i ] > H[ i - 1]*1.0013) { support[ i ] = H[ i - 1 ]*0.9945; } else if (L[ i ] > prev*1.1) { support[ i ] = prev*1.05; } else { support[ i ] = prev; } // trends prev = trends[ i - 1 ]; if (H[ i ] > prev AND H[ i - 1 ] > prev) { trends[ i ] = Max(prev,support[ i ]); } else if (H[ i ] < prev AND H[ i - 1 ] < prev) { trends[ i ] = Min(prev,resistance[ i ]); } else if (H[ i ] > prev) { trends[ i ] = support[ i ]; } else { trends[ i ] = resistance[ i ]; } } return trends; } // AFL code by E.M.Pottasch, 12/28/2010, // idea from: http://stocata.org/metastock/stop_trail_trends.html atrfact = Param("atrfact",2, 1, 10, 0.1); period = Param("period",10, 1, 100, 1); HiLo = IIf(H-L<1.5*MA(H-L,period),H-L,1.5*MA(H-L,period)); Href = IIf(L<=Ref(H,-1),H-Ref(C,-1),(H-Ref(C,-1))-(L-Ref(H,-1))/2); Lref = IIf(H>=Ref(L,-1),Ref(C,-1)-L,(Ref(C,-1)-L)-(Ref(L,-1)-H)/2); diff1 = Max(HiLo,Href); diff2 = Max(diff1,Lref); ATRmod = Wilders(diff2,period); loss = atrfact*ATRmod; resistance = C + loss; // calculate trends trends = trends_func(resistance); SetChartBkColor( ParamColor("ColorBG", ColorRGB( 0, 0, 0 ) ) ); GraphXSpace = 5; SetChartOptions(0, chartShowDates); Plot(IIf(trends > C,trends,Null),"\ntrailShort",ParamColor("ColorTrailShort",ColorRGB(255,0,0)),styleStaircase); Plot(IIf(trends < C,trends,Null),"\ntrailLong",ParamColor("ColorTrailLong",ColorRGB(0,255,0)),styleStaircase); _SECTION_END(); _SECTION_BEGIN("Candlesick Patterns"); Plot(C,"",colorLightGrey,styleCandle); r=CdDoji( threshold = 0.05 ); s=CdHammer( rangefactor= 1.1 ); t=CdBearishEngulfing( bodyfactor = 0.4, rangefactor = 0.5); u=CdBullishEngulfing( bodyfactor = 0.4, rangefactor = 0.5); PlotShapes(r*shapeSmallCircle,colorRed,Layer=0,yposition=H,Offset=12); PlotShapes(s*shapeCircle,colorYellow,Layer=0,yposition=H,Offset=12); PlotShapes(t*shapeHollowSmallCircle,colorLime,Layer=0,yposition=H,Offset=12); PlotShapes(u*shapeHollowCircle,colorBlue,Layer=0,yposition=H,Offset=12); for(i=0;i<BarCount-1;i++) { if(r[i]==True)PlotText("Doji", i, H[i], colorRed, bkcolor = colorDefault); if(s[i]==True)PlotText("Hammer", i, H[i], colorYellow, bkcolor = colorDefault); if(t[i]==True)PlotText("BearishEngulf", i, H[i], colorLime, bkcolor = colorDefault); if(u[i]==True)PlotText("BullishEngulf", i, H[i], colorBlue, bkcolor = colorDefault); } _SECTION_END(); _SECTION_BEGIN("Price"); SetChartOptions(0,chartShowArrows|chartShowDates); _N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) )); Plot( C, "Close", ParamColor("Color", colorBlack ), styleNoTitle | ParamStyle("Style") | GetPriceStyle() ); _SECTION_END(); _SECTION_BEGIN("Show Values at H&L"); n=Param("Values back",20,1,200,1); p=Param("zig %",5,1,100,1); dist = 0.8*ATR(15); for( i = 1; i < n; i++ ) { PlotText(""+LastValue(Peak(H,p,i),True),BarCount-3-LastValue(PeakBars(H,p,i)),LastValue(dist,True)+LastValue(Peak(H,p,i),False),colorBlack,ColorRGB(225,225,225)); PlotText(""+LastValue(Trough(L,p,i),True),BarCount-3-LastValue(TroughBars(L,p,i)),LastValue(Trough(L,p,i),False)-LastValue(dist,True),colorBlack,ColorRGB(225,225,225)); } _SECTION_END(); _SECTION_BEGIN("Price"); SetChartOptions(0,chartShowArrows|chartShowDates); _N(Title = StrFormat("{{NAME}} - {{INTERVAL}} {{DATE}} Open %g, Hi %g, Lo %g, Close %g (%.1f%%) {{VALUES}}", O, H, L, C, SelectedValue( ROC( C, 1 ) ) )); Plot( C, "Close", ParamColor("Color", colorBlack ), styleNoTitle | ParamStyle("Style") | GetPriceStyle() ); _SECTION_END(); _SECTION_BEGIN("Average Side Way Mkt"); price = ParamField("field"); n = Param("periods",35); SA=MA(Price,n); v1=(StDev(Price,n))^2; Ca=Null; Ca[n]=sa[n]; for(i=n+1; i<BarCount;i++){ v2[i]=(CA[i-1]-SA[i])^2; k[i]=IIf(V2[i]<V1[i],0,1-V1[i]/V2[i]); CA[i]=CA[i-1]+K[i]*(SA[i-1]-CA[i-1]); } Plot(Ca,"OMA("+WriteVal(n,1.0)+")",colorYellow,styleThick); Col = IIf(BarsSince(Ref(Ca,-1)>Ca)>BarsSince(Ref(Ca,-1)<Ca),colorBrightGreen,colorRed); Plot(C,"",Col,styleBar); _SECTION_END(); _SECTION_BEGIN("Bar Count Back V. Good"); //* Stephane Carrasset's Countback Line (CBL) popularized by Daryl Guppy //Refer to amibroker posting 30th December 2004 */ nR=2; Cbl[nR]=Null; bCBL=False; for( i=nR; i < BarCount; i++) { if( (Low[i-2]<Low[i-1]) && (Low[i-1]<Low[i]) ) { Cbl[i] = Low[i-2]; bCBL = True; } else if (bCBL) { if (Low[i] < Cbl[i-1]) { Cbl[i] = Cbl[i-1]; bCBL = False; } else { n = nR; minval[i] = Low[i]; breakloop= False; for (j = 1; NOT(breakloop) && j <= i; j++) { if (Low[i-j] < minval[i]) { if (n>1) { minval[i] = Low[i-j]; n--; } else { Cbl[i] = Low[i-j]; breakloop=True; } } } if (Cbl[i] < Cbl[i-1]) Cbl[i] = Cbl[i-1]; } } else { Cbl[i] = Cbl[i-1]; } if (Cbl[i]==0) Cbl[i] = Cbl[i-1]; } Plot(Cbl,"",colorGreen,1); Plot(C,"",-1,64); _SECTION_END(); _SECTION_END(); _SECTION_BEGIN("Background"); SetChartBkGradientFill(ParamColor("Top", colorTeal), ParamColor("Bottom", colorLightGrey), ParamColor("Title", colorTeal)); SetChartBkColor(ParamColor("Chart Background", colorWhite)); _SECTION_END(); _SECTION_BEGIN("Didi Index Indicator"); function DidiIndex( Curta, Media, Longa ) { global DidiLonga, DidiCurta; DidiLonga = MA( Close, Longa ) - MA( Close, Media ); DidiCurta = MA( Close, Curta ) - MA( Close, Media ); return IIf(DidiCurta > 0 AND DidiLonga < 0, 1,IIf(DidiCurta<0 AND DidiLonga>0, -1,0)); } MAFast = Optimize("Curta",Param("MA Curta",3,1,5 ),1,5,1); MAMid = Optimize("Media",Param("MA Média",8,6,12),6,12,1); MASlow = Optimize("Longa",Param("MA Longa",20,15,34),15,34,1); Trend = DidiIndex(MAFast, MAMid, MASlow); Buy = Cross(Trend,0) AND ADX()>MDI(); Sell = Cross(0,Trend); Buy = ExRem(Buy,Sell); Sell = ExRem(Sell,Buy); TrendColor = IIf(DidiCurta>0,colorLime,colorRed); Plot( DidiCurta, _DEFAULT_NAME(), TrendColor, ParamStyle("Histogram style", styleThick | styleHistogram | styleNoLabel, maskHistogram )); Plot(0,"", colorBrown ,styleLine); Plot(DidiLonga,"",IIf(DidiLonga<0,colorGreen,colorRed),styleLine | styleThick); Plot(DidiCurta,"",IIf(DidiCurta>0,colorGreen,colorRed),styleLine | styleThick); //Normal Buy and Sell Signal PlotShapes(Buy*shapeUpTriangle,colorBlue,0,-0.5); PlotShapes(Sell*shapeDownTriangle,colorPink,0,0.5); // The Best Signal: Didi Needleful PlotShapes((Cross(DidiCurta,0) AND Cross(0,DidiLonga)) * shapeHollowCircle, colorYellow,0,0.25); _SECTION_END();

Sign up here with your email

ConversionConversion EmoticonEmoticon