|

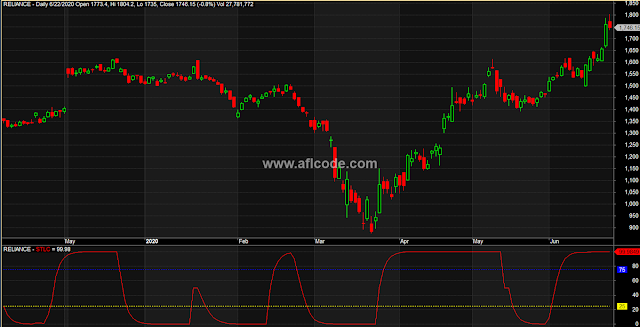

| Schaff Trend Cycle Indicator afl |

//www.aflcode.com MA1=23; MA2=50; TCLen=10; MA1=Param("ShortMACDLen",23,5,36); MA2=Param("LOngMACDLen",50,10,100); TCLen=Param("TCLen(StochPeriod)",10,5,20); Factor=.5; //Calculate a MACD Line XMac = MACD(MA1,MA2) ; // MACD in Amibroker always uses Close for MACD calculation //1st Stochastic: Calculate Stochastic of a MACD Value1 = LLV(XMac, TCLen); Value2 = HHV(XMac, TCLen) - Value1; //Frac1=1; // prime Frac1 to a default of 1 //Frac1 = IIf(Value2 > 0, ((XMac - Value1) / Value2) * 100, Ref(FRAC1,-1)); // have to "prime" first value so that reference to "i-1" does not result in subscript out of range // since MACD for both periods is not defined until MA2 period, 0 seems to be mathematically correct priming value frac1=0; for (i = 1; i < BarCount; i++) { if (Value2[i] > 0) { frac1[i] = ((XMac[i] - Value1[i])/Value2[i])*100; } else { frac1[i]= frac1[i-1]; } } //Smoothed calculation for %FastD of MACD PF[0]=frac1[0]; PF[1]=frac1[1]; for (i = 2; i < BarCount; i++) { PF[i]=PF[i-1]+(Factor*(frac1[i]-PF[i-1])); } //2nd Stochastic: Calculate Stochastic of Smoothed Percent FastD, above. Value3 = LLV(PF, TCLen); Value4 = HHV(PF, TCLen) - Value3; //%FastK of PF /* Frac2=1; Frac2 = IIf(Value4 > 0, ((PF - Value3) / Value4) * 100, Ref(FRAC2,-1)); */ frac2[0]=0; for (i = 1; i < BarCount; i++) { if (Value4[i] > 0 ) { frac2[i]=((PF[i] - Value3[i])/Value4[i])*100; } else { frac2[i]=frac2[i-1]; } } //Smoothed calculation for %FastD of PF PFF[0]=frac2[0]; PFF[1]=frac2[1]; for (i = 2; i < BarCount; i++) { PFF[i]=PFF[i-1]+(Factor*(frac2[i]-PFF[i-1])); } Plot(pff,"STLC",colorRed,styleLine); Plot(75,"",colorBlue,styleLine|styleDashed); Plot(25,"",colorYellow,styleLine|styleDashed);

Sign up here with your email

ConversionConversion EmoticonEmoticon